Simplify Your Shared Expenses with Sharpay: Embracing Financial Ease Through Installment Payback

Introduction:

Managing shared expenses can be a tricky task, especially when dealing with friends, roommates, or family members. The constant back-and-forth of splitting bills, tracking who owes what, and ensuring everyone pays their fair share can be overwhelming. However, with the advent of innovative financial technologies, there are now apps like Sharpay that aim to streamline this process and make shared expenses a breeze. One standout feature of Sharpay that deserves special attention is its installment payback option, allowing users to repay shared expenses in a way that fits their budget.

The Challenge of Shared Expenses:

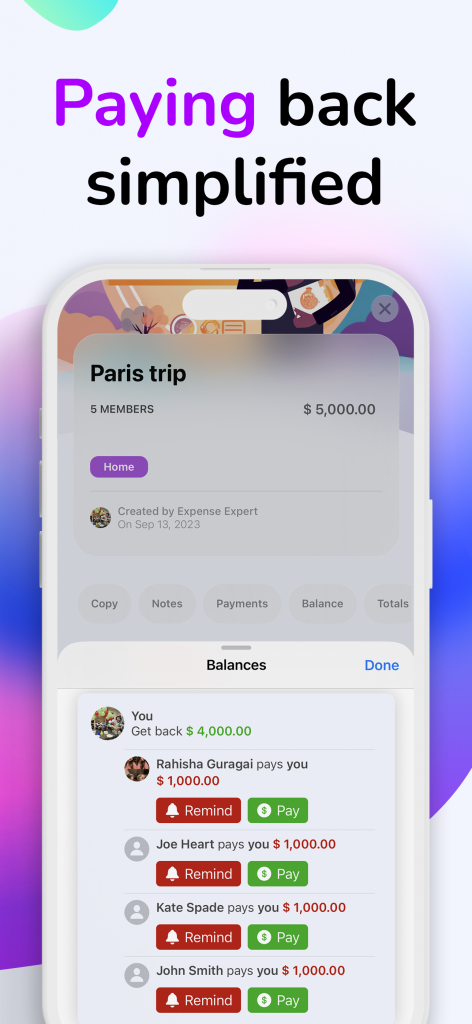

We’ve all been there – splitting a dinner bill, organizing a group trip, or sharing rent with roommates. While the idea of pooling resources can be efficient and cost-effective, the execution often leaves much to be desired. Keeping track of who owes what, chasing down payments, and ensuring everyone settles their debt on time can turn a simple outing into a headache. This is where Sharpay steps in, offering a solution that not only simplifies expense management but also introduces a flexible payback structure.

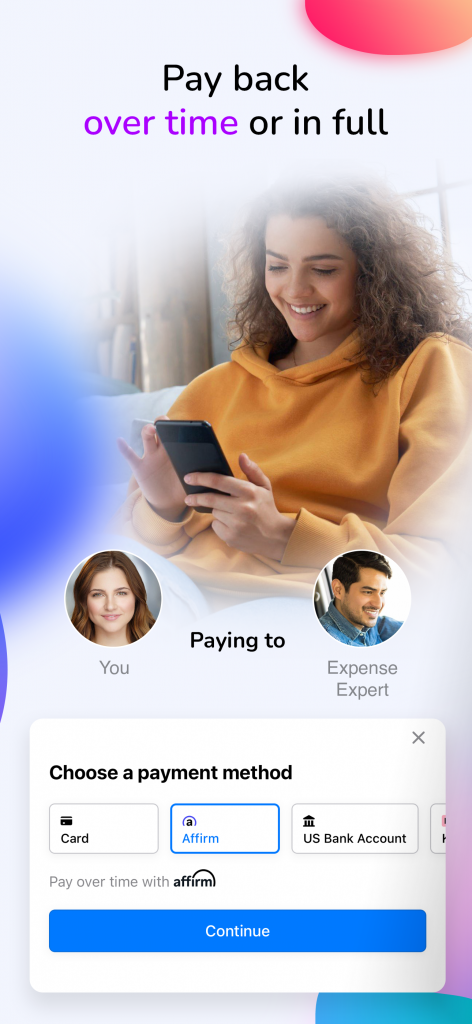

Installment Payback: A Game-Changing Feature

Sharpay’s installment payback feature takes the stress out of settling shared expenses by allowing users to repay their debts in easy, manageable installments. This feature is particularly useful when dealing with larger expenses, such as rent, utilities, or group vacations. Here’s why this functionality is a game-changer:

- Budget-Friendly Approach:

The ability to pay back shared expenses in installments means users can align their payments with their budget. This prevents the financial strain of a lump-sum payment, making it easier for everyone involved to meet their financial obligations without compromising on other essential expenses. - Flexibility for Users:

Installment payback offers unparalleled flexibility for users. Whether it’s a monthly, bi-monthly, or custom repayment schedule, Sharpay accommodates various preferences. This adaptability ensures that users can manage their finances in a way that suits their individual circumstances. - Avoiding Financial Strain:

Large expenses can often put a strain on individual finances. Sharpay’s installment payback feature ensures that users can meet their obligations without compromising their financial stability. This can contribute to better financial health and reduce the stress associated with shared expenses. - Built-In Tracking and Reminders:

Sharpay doesn’t just stop at providing a payback option. The app includes built-in tracking and reminders, making it easy for users to stay on top of their repayment schedule. This proactive approach ensures that everyone involved remains accountable and avoids late payments.

Conclusion:

In the era of digital solutions, managing shared expenses should be as seamless as the experiences they fund. Sharpay’s installment payback feature stands out as a key element in making this vision a reality. By combining financial technology with a user-friendly interface, Sharpay empowers users to navigate shared expenses with ease, promoting financial harmony and eliminating the headaches associated with group finances. So, if you’re tired of spreadsheet chaos and endless reminders, give Sharpay a try – your shared expenses will thank you.