Simplify Your Shared Expenses with Sharpay: A Mobile App Revolution

In the era of digital innovation, managing shared expenses has never been easier, thanks to the advent of mobile applications designed to streamline the process. Among the standout apps in this category is Sharpay, a powerful tool that takes the hassle out of splitting bills and managing shared finances. In this blog post, we will explore the features and benefits of Sharpay, highlighting how it has become a game-changer for individuals, friends, and families navigating the complexities of shared expenses.

The Rise of Shared Expenses Apps:

As our lives become increasingly interconnected, the need for efficient tools to manage shared expenses has grown exponentially. Whether it’s splitting rent with roommates, dividing grocery bills with a partner, or sharing travel expenses with friends, traditional methods of managing these financial interactions can be cumbersome and time-consuming. Shared expenses apps have emerged as a solution to this problem, providing users with a convenient and transparent way to handle financial transactions within their social circles.

Enter Sharpay:

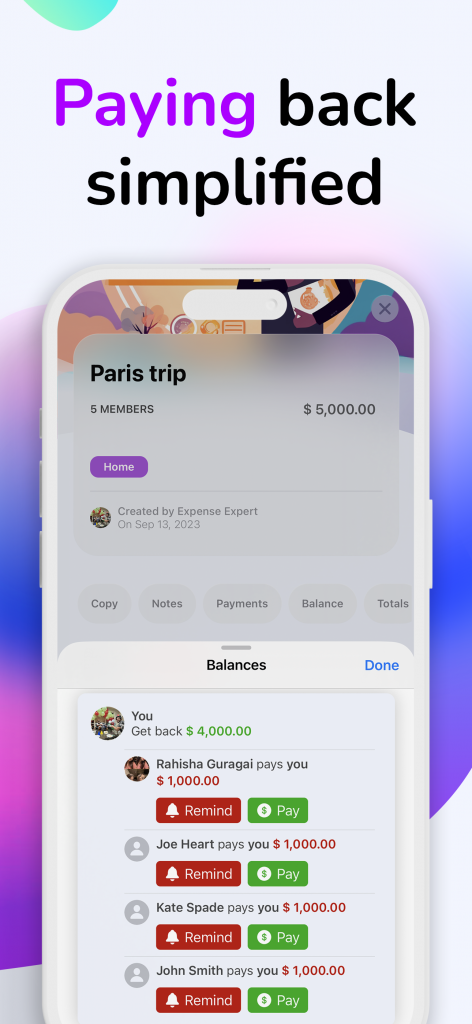

Sharpay distinguishes itself in the crowded landscape of shared expenses apps with its user-friendly interface, robust features, and a commitment to simplifying the financial aspects of interpersonal relationships. Let’s delve into some key features that set Sharpay apart:

- Intuitive Expense Tracking:

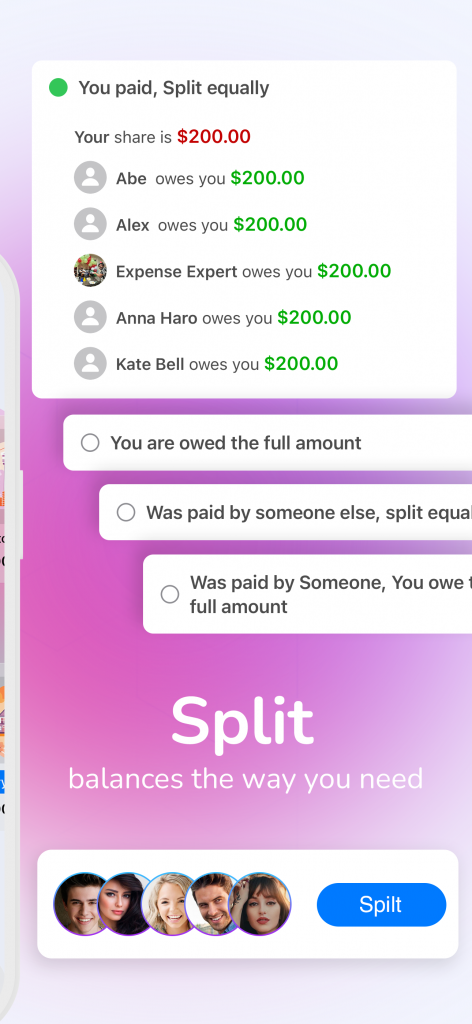

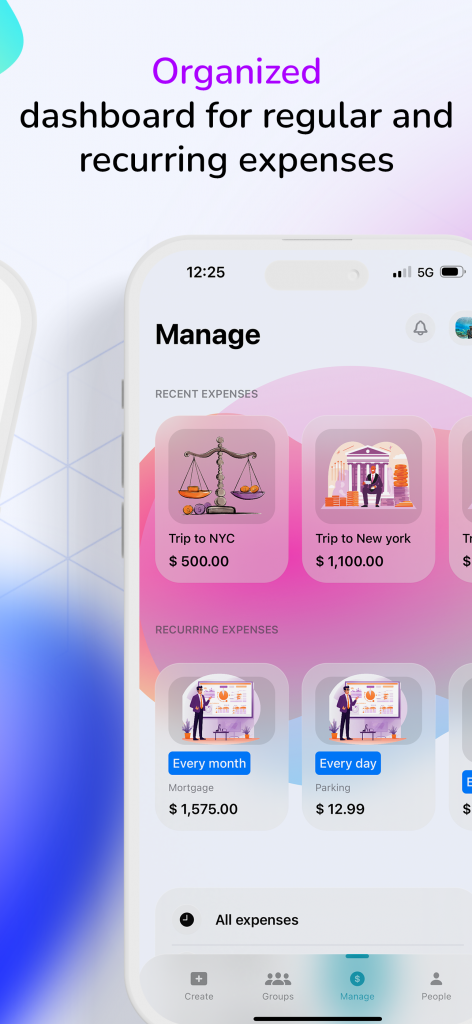

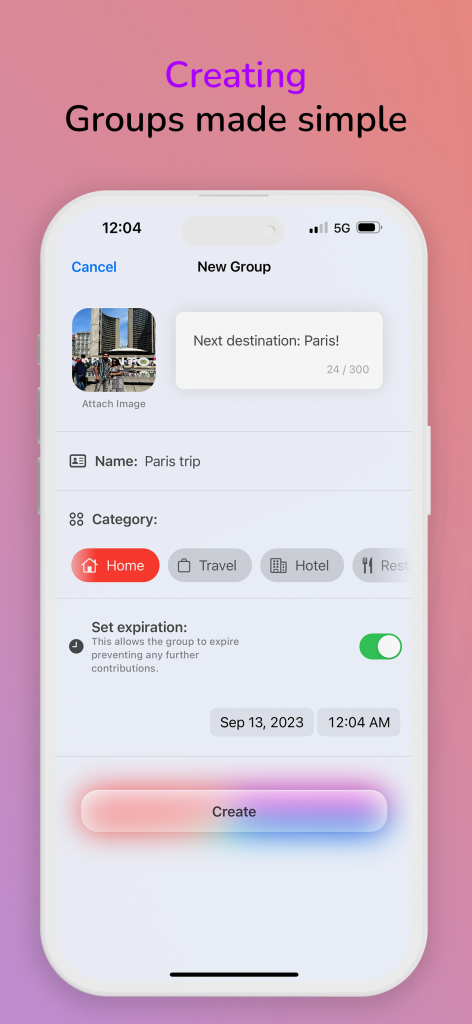

Sharpay makes tracking shared expenses a breeze. Users can easily input expenses, categorize them, and assign contributors. The app then calculates each person’s share, eliminating the need for manual calculations and reducing the potential for errors. - Real-time Updates:

One of the standout features of Sharpay is its ability to provide real-time updates. As expenses are added or settled, all users involved receive instant notifications. This transparency ensures that everyone is on the same page, reducing misunderstandings and promoting financial harmony. - Multiple Currencies and Splitting Options:

Sharpay recognizes the global nature of relationships and travel. It supports multiple currencies, making it an ideal tool for users with diverse international connections. Additionally, the app offers various splitting options, allowing users to customize how expenses are divided based on their preferences. - Expense History and Reports:

Sharpay keeps a detailed history of all shared expenses, providing users with a comprehensive overview of their financial interactions. The app also generates insightful reports, offering valuable insights into spending patterns and helping users make informed financial decisions. - Secure and Private:

Security is a top priority for Sharpay. The app employs robust encryption protocols to ensure that users’ financial data remains secure. Moreover, it respects user privacy, with stringent measures in place to protect personal information.

Conclusion:

In the ever-evolving landscape of financial technology, Sharpay stands out as a reliable and efficient solution for managing shared expenses. With its intuitive design, real-time updates, and commitment to user privacy, Sharpay has successfully addressed the pain points associated with shared finances. Whether you’re splitting bills with roommates, managing expenses within a family, or coordinating finances during travel, Sharpay is a versatile and indispensable tool that simplifies the complexities of shared expenses. Embrace the future of financial collaboration with Sharpay – where transparency meets convenience.