🎉 Exciting News for Android Users! 🎉

We’re thrilled to announce that Sharpay is now available on Android, bringing seamless expense management to your fingertips! 🚀

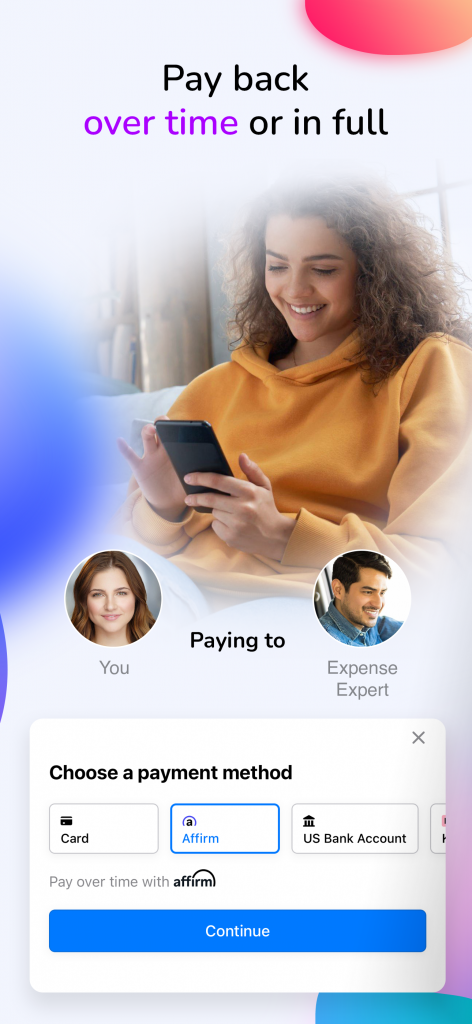

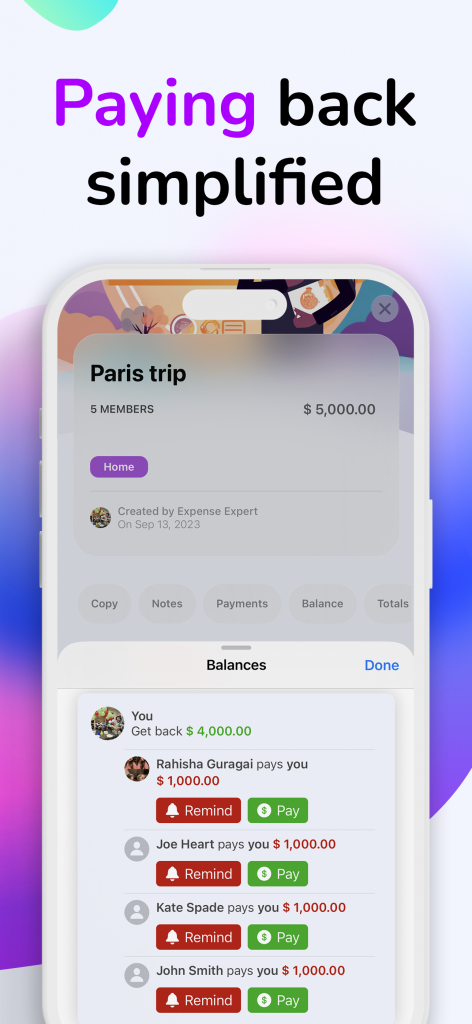

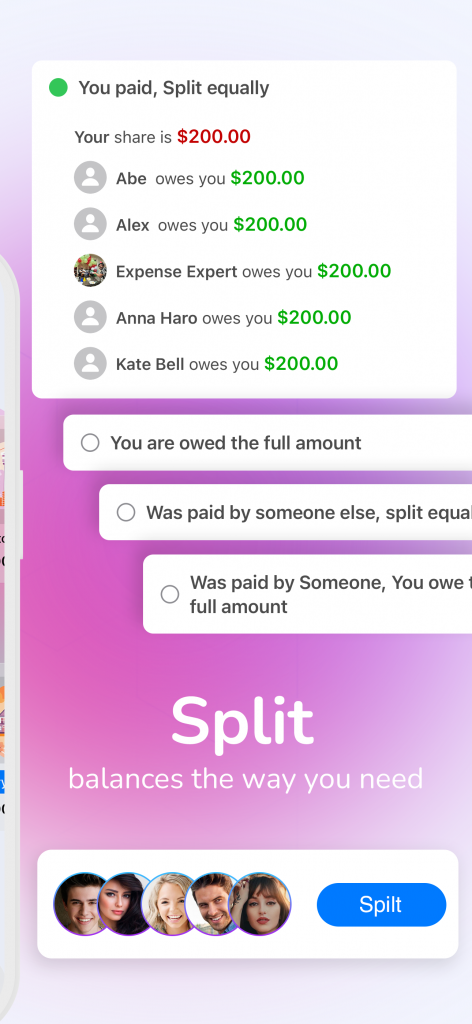

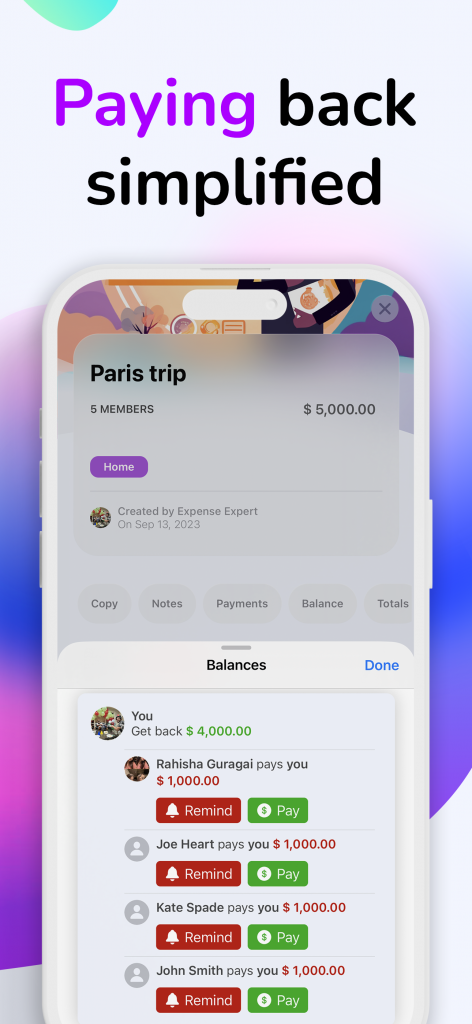

Managing shared expenses has never been easier, and with our Android release, we’re making it even more accessible to a broader community. Whether you’re planning a trip with friends, organizing a group project, or simply splitting bills at home, Sharpay is your go-to solution for hassle-free expense tracking.

Key Features on Android:

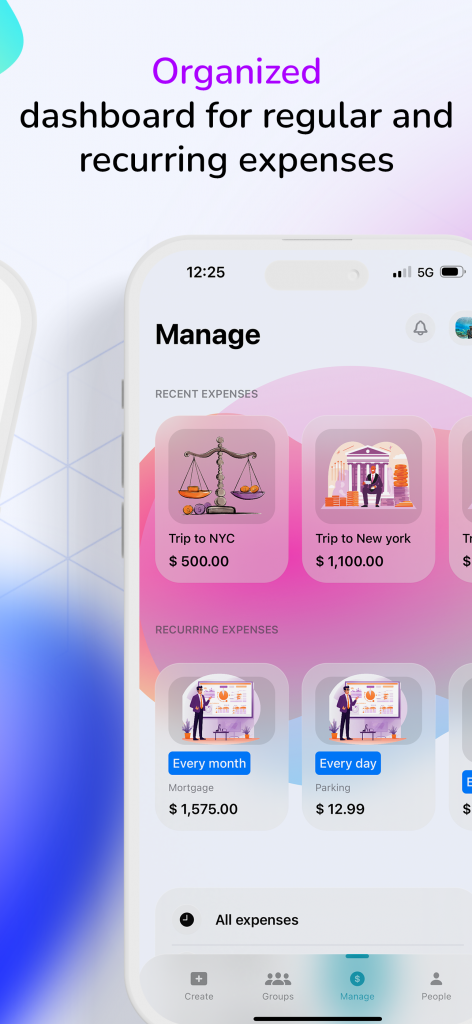

📱 User-Friendly Interface: Experience a sleek and intuitive design that makes managing shared expenses a breeze on your Android device.

🔄 Real-Time Updates: Stay in the loop with real-time updates on shared expenses, ensuring everyone is on the same page.

📊 Comprehensive Reports: Gain insights into your spending patterns and contributions through detailed reports, making budget management a transparent and collaborative process.

🔒 Secure and Private: Your financial data is our priority. Benefit from top-notch security features to ensure your information remains confidential.

How to Get Started:

1️⃣ Download Sharpay Shared Expense from the Google Play Store.

2️⃣ Sign up or log in to your account.

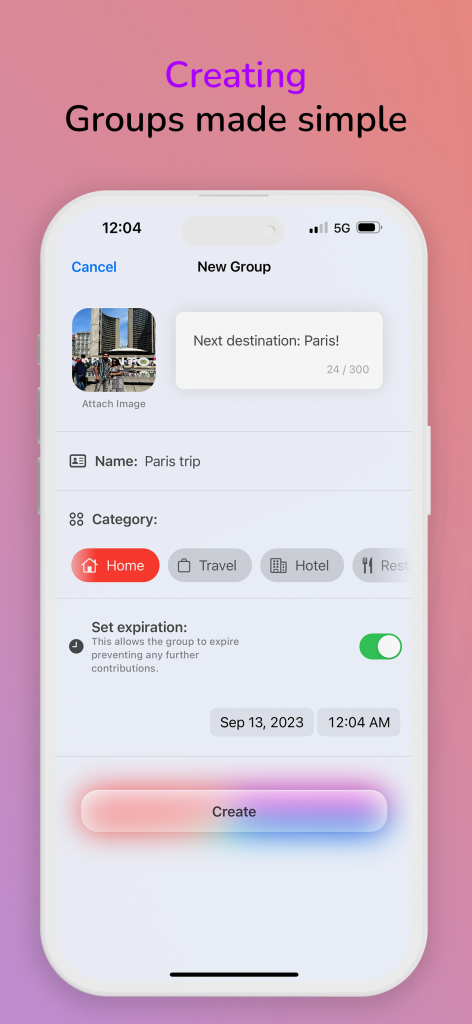

3️⃣ Create a new group or join an existing one.

4️⃣ Add expenses, and let Sharpay take care of the rest!

Whether you’re splitting bills with roommates, organizing a group event, or managing a team project, Sharpay Shared Expense on Android is here to simplify your financial collaboration. Say goodbye to the complexities of shared expenses and hello to a more organized and stress-free way of managing your finances.

Download Sharpay Shared Expense on Android today and start simplifying your shared expenses effortlessly! 💸📱 #SharpayOnAndroid #ExpenseManagement #FinanceMadeEasy